It’s obvious that the world’s becoming more digital as time goes on and this is quite apparent in the world of finance, where every conceivable activity can be done digitally. This, of course, requires the aid of reliable providers of FinTech software development services according to Kindgeek. So, how exactly do they pull off this colossal feat?

Well, if you’re interested in having some software built for you, the following will be of great use. Not only will you know how FinTech software development services build their products, you’ll get a great picture of what spaces in the field are worth exploring. FinTech is already huge, so this knowledge is bound to come in handy.

Contents

Financial Technology Overview

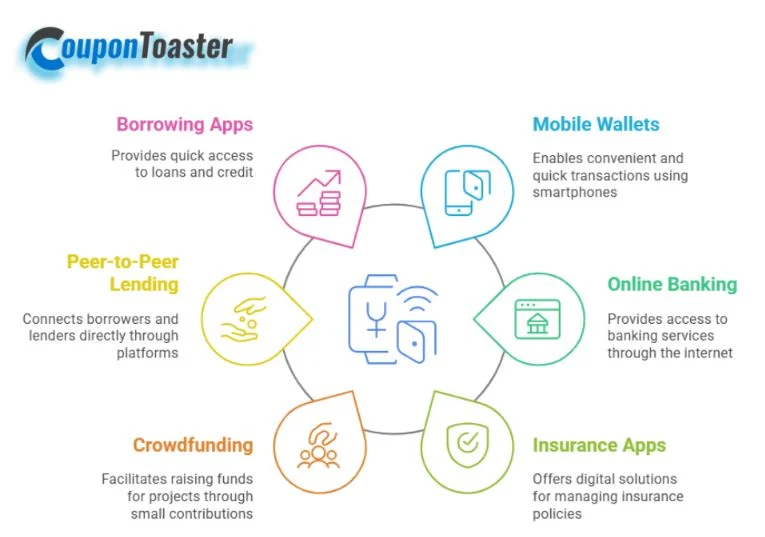

FinTech, also called financial technology, is any software that handles financial tasks, including payments, transfers, investments or insurance. If you have used a mobile wallet or an online banking platform, you have already experienced it’s power. It is so popular that more than five billion people rely on FinTech services in some form. The appeal lies in convenience, speed and the ability to handle transactions anytime, anywhere.

Different types of FinTech cover a wide range of needs, from peer-to-peer lending and crowdfunding to robo-advisors and cryptocurrency exchanges. By offering personalized services and robust security, these modern tools have transformed everyday banking and business operations. As FinTech continues to evolve, new solutions emerge, making financial management easier, more transparent and widely accessible.

- Online and mobile payment apps

- Banking apps

- Insurance apps

- Crowdfunding apps

- Peer-to-peer lending apps

- Borrowing apps

Whether for sending money overseas, analyzing spending patterns or securing loans through digital platforms, FinTech has become a trusted companion for billions of users worldwide. It’s future is bright.

Building The Desired Software

Developers have to be aware of what’s expected from the product they put out. Any functional creation from a FinTech software development service has to be able to perform the basics that products of this nature do. The chief things are as follows:

- creating a functional product (usually an app)

- bringing in of web-based solutions or platforms

- using API to allow information exchange

With that out of the way, we can properly get into what building these tools looks like. Building any kind of FinTech is pretty much a multiple stage process which is as follows:

Initial Planning

The initial phase of FinTech software development centers on creating a comprehensive project outline that serves as the foundation for all subsequent development stages. This outline meticulously details every component and requirement necessary for the project’s success. The scope and complexity of this outline are directly influenced by the specific requirements of the intended product, whether it’s a payment processing system, digital banking platform or investment management tool. Project managers and stakeholders must collaborate closely to define clear objectives, technical specifications and desired outcomes, ensuring that the development team has a well-defined roadmap to follow throughout the project lifecycle.

Initial Designing

The concept design phase represents a crucial stage in FinTech software development where teams transform project requirements into tangible design elements. During this period, developers and designers work collaboratively to create preliminary mockups, user interface designs and system architecture plans. This phase allows teams to identify potential challenges and optimize solutions before committing significant resources to development. Through careful analysis and iteration of the basic concept design, teams can refine user flows, enhance security protocols and streamline functionality. This proactive approach helps prevent costly modifications later in the development cycle and ensures the final product aligns perfectly with stakeholder expectations and user needs.

The Actual Build and Testing

Once the finer details have been ironed out, developers can properly begin the build as well as integration. When the project seems to have been completed, know that it’s far from the case. In fact, there are likely a few more things that have to be addressed before anything is to be deployed. This is why the systems have to be tested and worked on further. Consider a development agency specializing in Django to ensure software reliability.

The above steps all lead to deployment of a finished product. Said product has to be of good quality in order to be used by the public. It’s for this reason that certain practices have to be natural to developers, so they create the best tools possible. The key pillars of this that should be looked at are as follows:

- Compliance — it refers to how the product remains faithful to regulations set at any given time;

- Security — it speaks to the handling of financial data on all fronts;

- User experience — it speaks to a product’s ease of use;

- Scalability — it refers to how the FinTech product will deal with the growing number of users while maintaining quality;

- Flexibility — it refers to the improvement of a product without affecting security.

Featured Technology

Widespread as it is, many do have some concerns with FinTech. The fact that it’s entirely digital means that it’s open to cyber attacks, while also having some serious issues regarding regulation complexity.

Regulation Technology

Regulatory compliance in FinTech represents a complex but essential aspect of financial technology operations. RegTech solutions leverage advanced algorithms and automation to streamline compliance processes and maintain regulatory adherence. These sophisticated systems continuously monitor transactions, analyze data patterns and flag potential compliance issues in real-time. By automating regulatory monitoring and reporting, FinTech companies can significantly reduce the risk of non-compliance while maintaining operational efficiency.

Blockchain Technology

Blockchain technology represents a revolutionary advancement in secure, decentralized data management for the financial sector. This innovative system operates through a distributed network where each transaction is recorded across multiple nodes, ensuring unprecedented levels of security and transparency. In the context of decentralized finance and cryptocurrency operations, blockchain provides an immutable ledger system where all transactions are cryptographically secured and permanently recorded.

The technology’s inherent design eliminates the need for intermediaries while maintaining data integrity, as each transaction record is mathematically linked to previous entries and distributed across the network. This structure makes unauthorized alterations virtually impossible, significantly reducing the risks associated with traditional record-keeping systems.

Cloud Computing

Cloud computing represents a cornerstone of modern FinTech infrastructure, offering secure and scalable data storage solutions through virtualized server environments. This technology enables financial institutions to store and process vast amounts of sensitive information while maintaining robust security protocols. The distributed nature of cloud storage, combined with advanced encryption methods, significantly reduces the risk of data breaches and enables seamless, secure data transfers across authorized platforms and users.

Artificial Intelligence

Artificial Intelligence represents a transformative force in FinTech automation, leveraging it’s advanced learning capabilities and rapid processing power to optimize financial operations. As AI technology continues to mature, it’s applications in the financial sector expand, enabling more sophisticated automation of complex tasks. The technology’s ability to analyze patterns, learn from data and make intelligent decisions positions it as a crucial tool for enhancing operational efficiency and reducing manual intervention in financial processes.

Data Analytics Capabilities

Data analytics serves as a critical component in evaluating operational effectiveness in FinTech systems. By leveraging artificial intelligence and advanced analytics tools, businesses can conduct real-time performance assessments with unprecedented accuracy and speed. This data-driven approach enables organizations to identify strengths and weaknesses promptly, facilitating informed decision-making that drives business growth and operational excellence.

Final Thoughts

The role of FinTech in the present day can’t be overstated. The numbers alone prove that and those providing FinTech software development services have a huge hand in that. As the above information has shown, their job is far from easy and requires that they consider a lot. In doing said job, the lives of the customers are made more convenient.

Not only can they perform the financial activities remotely and from the comfort of their homes, businesses can reduce costs due to the automation of things. As time goes on, improvements in FinTech are going to be seen, which is quite the thought.

Summary

This article explores the processes and technologies involved in FinTech software development. It outlines the key stages of development, from initial planning and design to final deployment, emphasizing the importance of compliance, security, user experience, scalability and flexibility. The article details crucial technologies powering FinTech solutions, including regulatory technology (RegTech), blockchain, cloud computing, artificial intelligence and data analytics. Each technology serves specific purposes: RegTech manages compliance, blockchain ensures secure transactions, cloud computing provides safe data storage, AI enables automation and data analytics offers real-time performance assessment. The article concludes by highlighting FinTech’s significant role in modern finance, noting how it enhances convenience for customers while helping businesses reduce operational costs through automation.