When you take out a mortgage, you may be concerned about carrying debt and paying high interest rates over time. Paying off your mortgage early, on the other hand, may help you save money and relieve financial stress.

Before you make additional mortgage payments or totally pay off your debt, think about whether it’s the best option for you. It may make sense in certain situations but not in others. Here are some things to think about when deciding when to pay off your mortgage.

Contents

Is Paying Off Your Mortgage Early a Good Idea?

Depending on the amount of your mortgage, you may save thousands of dollars in interest by paying it off early. If you do this, you should preserve financial reserves to handle other day-to-day expenditures and any emergency repairs.

Assume you raise your monthly payments to $500. This allows you to pay off your mortgage in 20 years rather than 30. In this example, you would save $63,442 by paying a total of $109,045 in interest. There’s also the extra advantage of becoming debt-free a decade sooner than expected. The outcomes of this computation will, of course, be dependent on your present mortgage amount.

The vast majority of fixed-rate loans are repaid. Amortization refers to the practice of progressively repaying a debt. Initially, the bulk of your monthly mortgage payments is applied to interest, with the remainder applied to the principal loan amount. As your debt falls, your monthly payments will be directed mostly toward the principal.

When Should You Pay Off Your Mortgage Early?

It may seem to be a smart idea to pay off your mortgage as soon as you have the necessary funds, but there is more to consider. It makes a lot of sense if you have a compelling financial motive to pay off your mortgage sooner than intended. For example, if you intend to retire sooner than planned, you should avoid taking out a mortgage or even something like loans online same day deposit during your retirement years.

However, no matter how you do it, paying off your mortgage early ties up a large amount of liquidity that you might use to invest and develop additional wealth or save for unforeseen rough times. You will also no longer be eligible for various tax breaks that you may use while aggressively paying down your mortgage.

Finally, the best time to pay off your mortgage early is determined by your unique financial circumstances. It must be a period that will not harm you financially and will help you in the long run. We suggest consulting with your financial adviser to find the best time for your particular circumstances.

Methods for Paying Off Your Mortgage Early

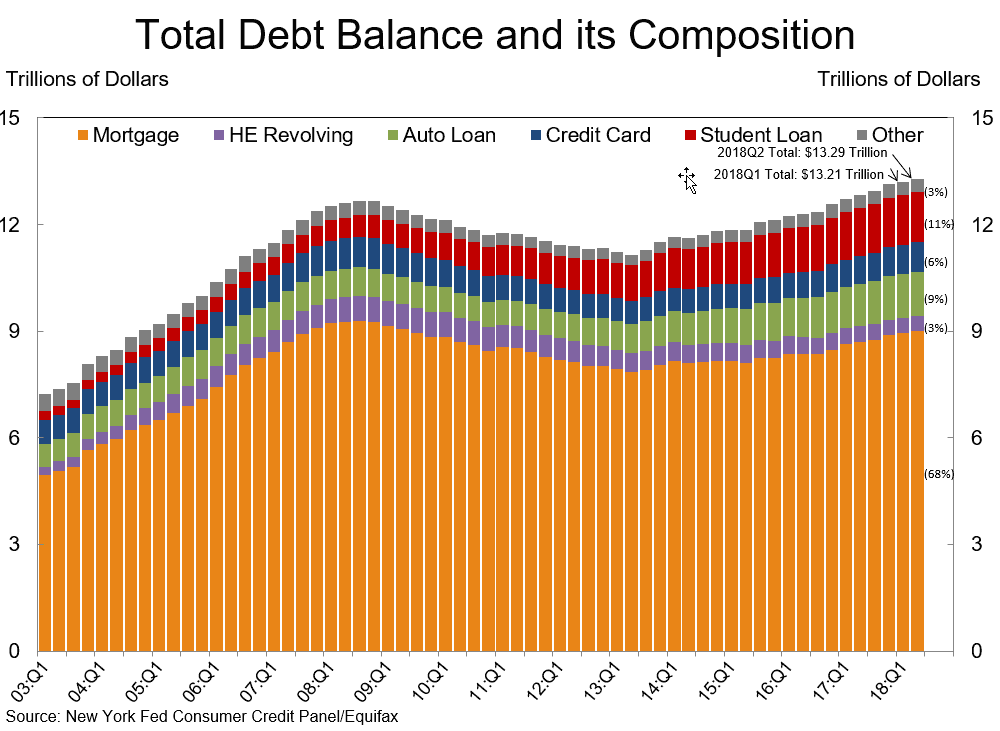

As we can see, mortgages consistently remain the most expensive and long-term loan among Americans. In general, mortgage debt among Americans has remained at $9 trillion in recent years, and this actualizes the importance of a deliberate approach to repayment for every citizen who has such debt.

If you’ve determined that paying off your mortgage early is the best option for you, there are many options. You don’t have to pour your whole savings account towards paying off the debt. Consider these alternatives to paying off your mortgage early.

Make Payments Every Two Weeks

A normal mortgage calls for a monthly payment throughout the life of the loan. Some mortgage lenders and services enable you to switch to biweekly payments, which may speed up your repayment by taking advantage of how mortgage interest is calculated and paid.

Make a Monthly Additional Payment

Paying more than the statutory amount each month is another option to pay off your mortgage quickly. Most lenders will let you set up automatic payments for whatever amount you choose. So, you may raise your payments by a few dollars or by a large amount, depending on what works best for your budget.

Some individuals even take out 30-year loans but agree to pay as if they were taking out a more costly 15-year loan. In this manner, clients may save time and money while still having the option to pay less if necessary.

Another method is to split the total amount owing each month by 12 and add that additional amount each month. This, like the biweekly payment arrangement, will result in one more mortgage payment every year.

Refinance Your Mortgage

Consider a mortgage recast if you have a lump amount, such as $5,000 or $10,000. You would send the funds to your lender to lower your loan principal and recalculate your mortgage payments. Your term will remain the same, but your new payments will be reduced, allowing you to make additional payments against your principal as regularly as feasible.

Because you will pay lower costs, a recast might be a suitable option to refinance. Recasts are not permitted for FHA or VA loans, but you may still go ahead by making additional mortgage payments with the lump amount.

Reduce Your Spending and Apply the Savings To Your Mortgage

Depending on how soon you want to pay off your mortgage, you may choose to cut little, recurrent costs or focus on the bigger ones. This may mean eating less out and canceling a few streaming subscriptions, or it could mean downsizing your house – pick the lifestyle adjustments that will help you accomplish your financial and quality of life objectives.

Role of Refinancing

Refinancing can play a crucial role in your mortgage payoff strategy. By refinancing to a lower interest rate or shorter term, you might be able to pay off your mortgage faster without significantly increasing your monthly payment.

Here’s how refinancing could impact a $200,000, 30-year mortgage:

| Scenario | Original Loan | Refinanced Loan |

| Interest Rate | 5% | 3.5% |

| Monthly Payment | $1,074 | $898 |

| Total Interest Paid | $186,512 | $123,312 |

In this scenario, refinancing could save over $60,000 in interest over the life of the loan, while also reducing the monthly payment. However, it’s important to factor in the costs of refinancing, which can be several thousand dollars.

Conclusion

Whether you should pay off your mortgage early is ultimately determined by how much money you have available, what your options are, and other personal variables. However, if it’s something that’s really on your mind, be sure to carefully explore all of your choices.

Although many financial advisers are recognized for their skills in investing and financial planning, many are also knowledgeable in mortgages and property purchases. So, if you’re having trouble choosing on your own, go to a local financial expert.