I want to share some game-changing strategies I’ve used to measure the success of healthcare hiring practices. These methods are inspired by Robert Kaplan and David Norton’s book “The Balanced Scorecard.” What I love about this approach is how it looks at success from different angles, not just the usual numbers game. It’s about seeing the whole picture of how your hiring affects your healthcare organization.

I’ve been using these techniques in my hiring process, and they’ve really opened my eyes to what’s working and what’s not. They’ve helped me spot issues I didn’t even know were there and find ways to fix them. One reason I stick with this method is that it helps me connect the dots between hiring and how well the organization is doing overall.

By looking at different areas and asking the right questions, I’ve seen a big improvement in the quality of our hires and how they fit into our team. These techniques have helped me focus on what really matters in healthcare hiring, making the whole process more effective. It’s made a huge difference in how we build our team, and I’m excited to share these ideas with you.

Contents

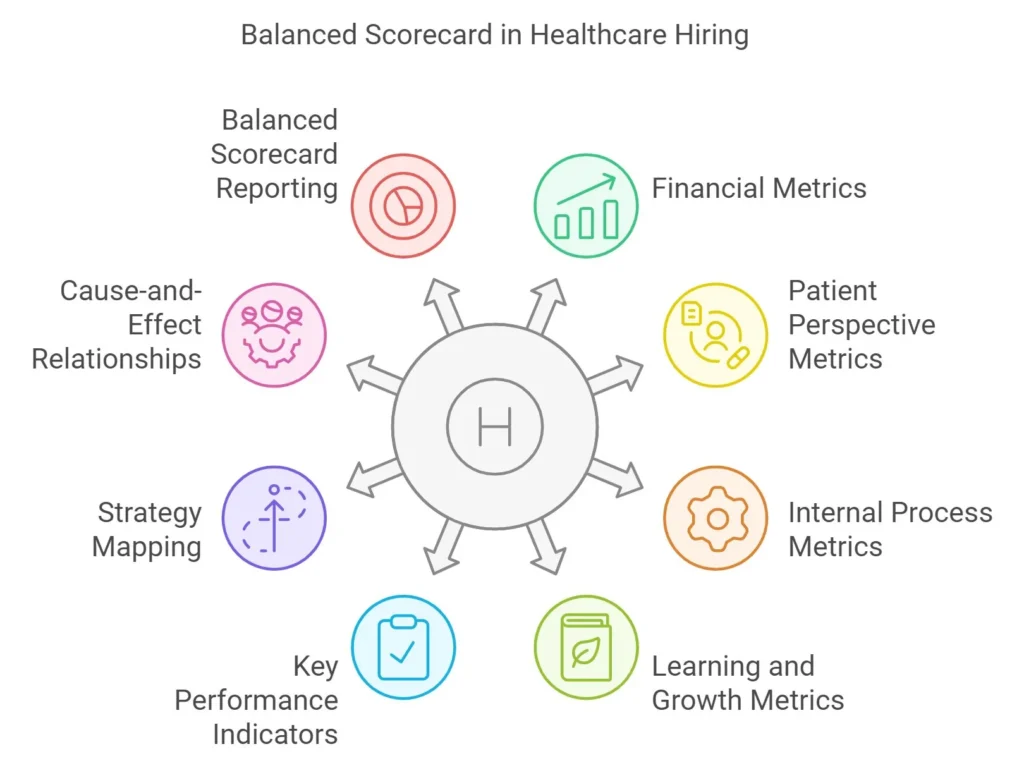

Here are the key techniques inspired by “The Balanced Scorecard” for measuring healthcare hiring success:

- Financial Perspective Metrics.

- Customer (Patient) Perspective Metrics.

- Internal Business Process Metrics.

- Learning and Growth Metrics.

- Key Performance Indicators (KPIs).

- Strategy Mapping.

- Cause-and-Effect Relationships.

- Balanced Scorecard Reporting.

- Cascading Scorecards.

- Regular Review and Adjustment.

These 10 techniques have become an integral part of our team’s healthcare hiring process, helping us make more informed decisions and improve our overall hiring success.

- Financial Perspective Metrics: Our team always starts by looking at the financial implications of our hiring decisions. We analyze cost-per-hire, time-to-productivity, and return on hiring investment. This helps us understand the financial impact of our hiring practices and justify our decisions to upper management.

- Customer (Patient) Perspective Metrics: We consider how our hiring decisions affect patient satisfaction. Our team tracks metrics like patient feedback scores and complaint rates before and after new hires join. This ensures we’re bringing in staff who align with our patient-centric approach.

- Internal Business Process Metrics: Our hiring team focuses on streamlining the recruitment process. We measure things like time-to-fill positions, interview-to-offer ratios, and onboarding efficiency. By optimizing these processes, we ensure we’re not losing top candidates to competitors.

- Learning and Growth Metrics: We track how new hires contribute to our organization’s knowledge base. This includes measuring their participation in training programs, contribution to process improvements, and ability to adapt to new technologies. It helps us identify candidates who will drive our organization forward.

- Key Performance Indicators (KPIs): Our team has developed specific KPIs for different roles. For nurses, we might look at patient care scores, while for administrative staff, we might focus on efficiency metrics. These KPIs help us evaluate the success of our hires over time.

- Strategy Mapping: Before starting any hiring process, we create a strategy map that links our hiring decisions to overall organizational goals. This helps us ensure that every hire contributes to our long-term objectives, whether it’s improving patient care or expanding services.

- Cause-and-Effect Relationships: We regularly analyze how our hiring decisions impact various aspects of our healthcare facility. For example, we might look at how hiring additional nursing staff affects patient wait times or satisfaction scores. This helps us make more strategic hiring decisions.

- Balanced Scorecard Reporting: Our team has developed a comprehensive hiring scorecard that we review monthly. It includes all the key metrics from different perspectives, giving us a balanced view of our hiring success. This report is shared with leadership to demonstrate the value of our hiring strategies.

- Cascading Scorecards: We’ve implemented department-specific scorecards that align with our overall hiring scorecard. This allows each department to focus on metrics that are most relevant to them while still contributing to our overall hiring goals.

- Regular Review and Adjustment: Every quarter, our team sits down to review our hiring metrics and strategies. We look at what’s working, what’s not, and make adjustments accordingly. This continuous improvement process ensures our hiring practices stay effective and aligned with our organization’s changing needs.

While insights from frameworks like the Balanced Scorecard are valuable, the backbone of any successful healthcare hiring strategy lies in tracking and analyzing specific recruitment metrics. These metrics provide concrete data that can guide decision-making, highlight areas for improvement, and demonstrate the effectiveness of your hiring processes. By consistently monitoring these metrics, healthcare organizations can optimize their recruitment strategies, reduce costs, and ultimately improve patient care through better staffing.

The Importance of Tracking Recruitment Metrics

Healthcare organizations must use data to ensure their hiring practices are optimal. This allows them to make changes where needed to improve hiring success. Why is this important? Healthcare organizations must track recruitment metrics to measure the effectiveness of their strategies. This allows the organization to make data-driven decisions rather than relying on intuition or guessing what works. The information gathered ensures the organization has diverse hiring practices, is in a position to attract top talent while retaining current staff, and can plan for the future. What metrics should be tracked?

Engagement

Engagement with job candidates helps organizations source top talent and build their talent pool. This engagement improves all KPIs. Every organization should track job applications from active candidates, interest from passive candidates, passive candidates who become active, and the conversion rate of passive candidates accepting job offers. When it comes to engagement in healthcare recruitment, the stakes are high. If our engagement levels are strong, we’re likely seeing a steady stream of quality applications and interested candidates. This means we’re able to fill positions more quickly and with better-fit candidates. For instance, if we’re getting a lot of interest from passive candidates – those not actively job hunting but open to opportunities – it’s a good sign that our employer brand is strong and our outreach efforts are effective.

On the flip side, if engagement is low, we might be facing some serious challenges. Maybe our job postings aren’t appealing, or we’re not reaching the right audience. I’ve seen situations where low engagement led to positions staying open for months, putting strain on existing staff and potentially compromising patient care. In one case, we realized our engagement was low because we weren’t showcasing our workplace culture effectively. Once we started sharing more about our team dynamics and growth opportunities, we saw a significant uptick in candidate interest.

Fill Time

How long does it take the organization to move from initiating the hiring process to acceptance of an offer by a candidate? Many organizations spend 59.5 days filling an open position. Healthcare organizations must know this to determine whether their hiring process is efficient or needs to be changed. Time to hire is also necessary, as open positions hurt the organization’s bottom line while burdening existing staff. Burnout becomes a concern when an organization has multiple open positions simultaneously. In my experience, fill time is a critical metric that can make or break a healthcare organization’s staffing strategy. The industry average of 59.5 days you mentioned is a good benchmark, but I’ve seen it vary widely depending on the role and location. For specialized positions like experienced nurses or specialized physicians, it’s not uncommon to see fill times stretch to 90 days or more.

Here’s the thing: every day a position remains unfilled is a day we’re potentially compromising on patient care quality. I recall a situation where we had multiple nursing positions open simultaneously. Our fill time had crept up to 75 days, and we could see the impact on our existing staff. Overtime hours were through the roof, and we were seeing signs of burnout – increased call-outs, decreased patient satisfaction scores, and even a couple of resignations.

We knew we had to act fast. We streamlined our hiring process, cutting out unnecessary steps and leveraging technology for initial screenings. We also ramped up our employee referral program. The result? We managed to bring our fill time down to 45 days. The impact was almost immediate – staff morale improved, overtime costs decreased, and most importantly, our patient care metrics started trending up again.

On the other hand, I’ve also seen organizations with impressively low fill times – around 30-40 days – for most positions. These organizations typically have a few things in common: a strong employer brand, efficient hiring processes, and often, good relationships with local nursing schools or medical training programs. The key is to find the right balance. While we want to fill positions quickly, we can’t compromise on quality. It’s about being efficient in our processes while still ensuring we’re making the right hiring decisions for our patients and our team.

Applicant-to-Hire Ratio

The applicant-to-hire ratio is a fascinating metric that can tell us a lot about the efficiency of our hiring process and the quality of our applicant pool. This ratio represents the number of applications we receive for each position we fill. A high ratio isn’t always better – it could mean we’re attracting a lot of unqualified candidates, which wastes time and resources.

In healthcare, I’ve seen this ratio vary widely. For entry-level positions like medical assistants or orderlies, it’s not uncommon to see ratios of 50:1 or higher. For more specialized roles like experienced RNs or physicians, the ratio might be closer to 10:1 or even 5:1.

Here’s where it gets interesting:

- If the ratio is too high (let’s say 100:1 for a nursing position), it could indicate that our job descriptions aren’t specific enough, or we’re not effectively pre-screening candidates. This leads to a lot of unqualified applications, bogging down our hiring process.

- On the other hand, if the ratio is too low (say 3:1 for a common role), we might not be casting a wide enough net. We could be missing out on great candidates or facing a shortage of interested applicants.

The sweet spot depends on the role, but generally, a ratio between 10:1 and 30:1 for most healthcare positions allows for a good selection of candidates without overwhelming the hiring team.

I remember a case where a hospital was struggling with a high applicant-to-hire ratio of 80:1 for nursing positions. Upon investigation, we found that their online application was too simple, allowing unqualified candidates to apply easily. By adding a few pre-screening questions and clearly stating required qualifications, they were able to bring the ratio down to 25:1. This not only saved time in the hiring process but also resulted in higher quality hires.

Conversely, I worked with a rural clinic that had a very low ratio of 4:1 for most positions. They were struggling to attract candidates. By expanding their online presence, offering relocation assistance, and highlighting the benefits of working in a close-knit community, they were able to boost their ratio to a healthier 15:1, giving them a better selection of candidates to choose from.

The key is to monitor this ratio over time and for different positions. If you see significant changes or outliers, it’s a signal to investigate your recruitment strategies and potentially make adjustments to your sourcing or screening processes.

Healthcare organizations need to track their applicant-to-hire rate. This information lets the organization know whether its recruitment efforts attract qualified candidates. When this ratio is high, the organization is reaching many candidates, but these candidates may not have the required qualifications. A low ratio suggests the recruitment process isn’t working.

Offer Acceptance

Healthcare organizations need a high offer acceptance rate (OAR) to decrease recruiting costs. This metric provides information about the quality of job offers and lets the organization know whether it distinguishes itself in a competitive field. A low OAR suggests the organization needs to offer better salaries, benefits, and perks.

Offer Acceptance Rate is a critical metric in healthcare recruiting. It’s calculated by dividing the number of accepted job offers by the total number of offers extended, then multiplying by 100 to get a percentage.

In practical terms:

- A low OAR is generally considered to be below 70%.

- A good OAR in healthcare is typically 85% or higher.

- An excellent OAR would be 90% or above.

If an organization is seeing an OAR of 65%, for instance, it’s a red flag. This could indicate that the compensation package isn’t competitive, the organization’s reputation might be suffering, or there could be issues with the recruitment process itself.

On the other hand, an OAR of 88% suggests that the organization is doing well in attracting and securing top talent. They’re likely offering competitive salaries, good benefits, and have a strong employer brand.

Is a low OAR something to worry about? Absolutely. It means the organization is investing time and resources into candidates who ultimately don’t join the team. This extends vacancies, increases recruitment costs, and can lead to settling for less qualified candidates to fill positions.

To improve a low OAR:

- Review and adjust compensation packages.

- Enhance the employer brand.

- Improve the candidate experience during the hiring process.

- Ensure job descriptions accurately reflect the role.

- Provide clear career progression paths.

Sourcing Channels

Healthcare organizations typically use multiple sourcing channels to recruit job candidates. Which sources provide the best ROI? Organizations need this information to know where to focus their efforts and maximize recruitment funds.

Measuring the effectiveness of sourcing channels is crucial for optimizing recruitment efforts. In healthcare, common sourcing channels include job boards, professional networking sites, employee referrals, career fairs, and partnerships with medical schools or nursing programs.

To practically measure the effectiveness of these channels:

- Use Applicant Tracking System (ATS) data: Most modern ATS platforms allow candidates to select where they found the job opening. This data can be analyzed to see which channels are bringing in the most candidates.

- Quality of candidates: Track how many candidates from each source make it to the interview stage, receive offers, and are ultimately hired.

- Cost per hire from each channel: Calculate how much is spent on each channel and divide it by the number of successful hires from that channel.

- Time to hire: Measure how quickly candidates from different sources move through the hiring process.

- Retention rates: Track how long hires from different sources stay with the organization.

In terms of data collection, it’s common to include a required field in the application form asking, “How did you hear about this position?” with a dropdown menu of options. This ensures consistent data collection across all applicants.

A practical approach might look like this:

- Job board A: 100 applicants, 10 interviews, 2 hires, $5000 spent.

- Employee referrals: 20 applicants, 8 interviews, 3 hires, $1000 spent (referral bonuses).

- LinkedIn: 50 applicants, 5 interviews, 1 hire, $2000 spent.

From this data, it’s clear that employee referrals are the most efficient channel in this example, with the highest conversion rate and lowest cost per hire.

Cost Per Hire

Organizations spend thousands of dollars on each hire. The cost per hire allows healthcare organizations to determine how much they should budget for recruitment efforts each year.

Cost per hire is a crucial metric that helps organizations understand the financial investment required to bring new talent on board. It’s typically calculated using this formula:

Cost per Hire = (External Costs + Internal Costs) / Total Number of Hires

External costs might include:

- Job board fees

- Agency fees

- Advertising costs

- Career fair expenses

- Referral bonuses

Internal costs could include:

- Recruiter salaries

- Time spent by hiring managers on interviews

- Onboarding and training costs

Many organizations use HR software or Applicant Tracking Systems to help calculate this automatically, but it can also be done manually by carefully tracking all associated costs.

In the U.S. healthcare sector, the average cost per hire can vary widely depending on the role:

- For entry-level positions, it might be around $3,000 – $5,000.

- For experienced nurses, it could range from $15,000 – $25,000.

- For physicians, it can easily exceed $250,000, especially for specialists.

Costs can go high due to:

- Lengthy vacancies requiring overtime or temporary staff.

- Expensive job board postings or agency fees for hard-to-fill roles.

- Extensive background checks and credentialing processes.

To lower costs:

- Develop a strong employee referral program.

- Build partnerships with local medical and nursing schools.

- Improve the employer brand to attract more direct applicants.

- Streamline the hiring process to reduce time-to-hire.

- Invest in retention strategies to reduce turnover.

While a “zero-cost” hire is rarely achievable in healthcare due to necessary background checks and credentialing, focusing on employee referrals and building a strong employer brand can significantly reduce costs. This information will also enable them to remain competitive in this area. However, a high cost per hire could indicate that the company is attracting and training top talent.

Hire Quality

Companies must ensure their hires are good fits. While this is important in any industry, it can mean the difference between life and death in healthcare. Engaged healthcare professionals reduce medical errors and lead to better outcomes and patient satisfaction.

Good quality hires typically:

- Quickly adapt to the organization’s workflows.

- Receive positive feedback from patients and colleagues.

- Meet or exceed performance metrics for their role.

- Engage in continuous learning and improvement.

- Stay with the organization beyond the initial probationary period.

Poor quality hires might:

- Struggle to meet basic job requirements even after training.

- Receive frequent complaints from patients or colleagues.

- Require constant supervision.

- Show resistance to following established protocols.

- Leave the organization quickly or be terminated during probation.

To distinguish good hires during the process:

- Use structured interviews with scenario-based questions.

- Implement skills assessments relevant to the role.

- Check references thoroughly, asking about specific competencies.

- Use personality assessments to ensure cultural fit.

- Have candidates shadow for a day to see how they interact in the actual work environment.

If a mistake is made and a poor-quality hire joins the team:

- Identify the issue early through regular check-ins and performance reviews.

- Provide additional training and support if the issue seems addressable.

- If problems persist, don’t hesitate to cut losses during the probationary period.

- Use the experience to refine the hiring process – what was missed during recruitment.?

- Be transparent with the team about steps being taken to address the situation.

Diversity

Diversity is critical in healthcare. Research shows patients feel more comfortable with medical professionals who share similar characteristics. Furthermore, hiring and retaining top talent is easier when an organization has a diverse workforce.

Every organization, including healthcare organizations, must attract top talent to remain competitive. These metrics can help organizations learn more about the recruitment process and where improvements can be made to reduce the burden on current staff. When these changes are made, recruiting top talent becomes easier, and staff turnover is reduced.