Ripple, a trailblazer in the blockchain space, transforms global financial transactions through it’s decentralized network and native digital asset, XRP. Deviating from traditional financial systems, it tackles cross-border inefficiencies. As a pioneer, Ripple leverages advanced technology to redefine financial transactions, aspiring to create a more inclusive, secure and efficient global network.

Contents

The Foundation of Ripple

Helpful Resource: To gain a deeper understanding of Ripple or other crypto projects, you can visit btciplex.com, where you can connect with educational experts who illuminate the com

Overview of Ripple’s Origin and Purpose

Ripple, founded with the vision of revolutionizing financial transactions, sought to establish a decentralized network that could operate independently of central authorities. It’s primary objective is to streamline and expedite cross-border payments, promoting financial inclusion and accessibility. Ripple distinguishes itself from traditional blockchains by employing a consensus algorithm that eliminates the need for energy-intensive mining. This energy-efficient approach enhances transaction speed and reduces environmental impact, setting Ripple apart from it’s counterparts.

Central to Ripple’s architecture is the XRP Ledger, a decentralized ledger that records all transactions. Ripple utilizes a unique consensus mechanism known as the Ripple Protocol Consensus Algorithm (RPCA), facilitating agreement among nodes without the energy-intensive proof-of-work associated with other blockchains.

In 2012, Ripple launched its first product, OpenCoin, a payment system that used the XRP token. At the time, the regulatory environment for cryptocurrencies was largely unclear. However, as Ripple grew, it attracted the attention of regulators. In 2015, the US Financial Crimes Enforcement Network (FinCEN) fined Ripple $700,000 for violating anti-money laundering (AML) regulations. FinCEN alleged that Ripple had failed to implement adequate AML controls and had not registered as a money services business.

Compliance and Expansion (2015-2018): In response to the FinCEN fine, Ripple implemented new AML controls and registered as a money services business. The company also obtained licenses and partnerships with banks and financial institutions, expanding its services to include cross-border payments and liquidity provision. During this period, Ripple worked to build relationships with regulators and demonstrate its commitment to compliance.

SEC Lawsuit (2020-Present): In December 2020, the US Securities and Exchange Commission (SEC) filed a lawsuit against Ripple, alleging that its XRP token is a security, not a currency, and therefore subject to SEC regulations. The SEC claims that Ripple raised over $1.3 billion through the sale of XRP without registering it as a security. Ripple disputes this claim, arguing that XRP is a currency and should be regulated as such.

So What Actually Is Ripple Trying To Do?

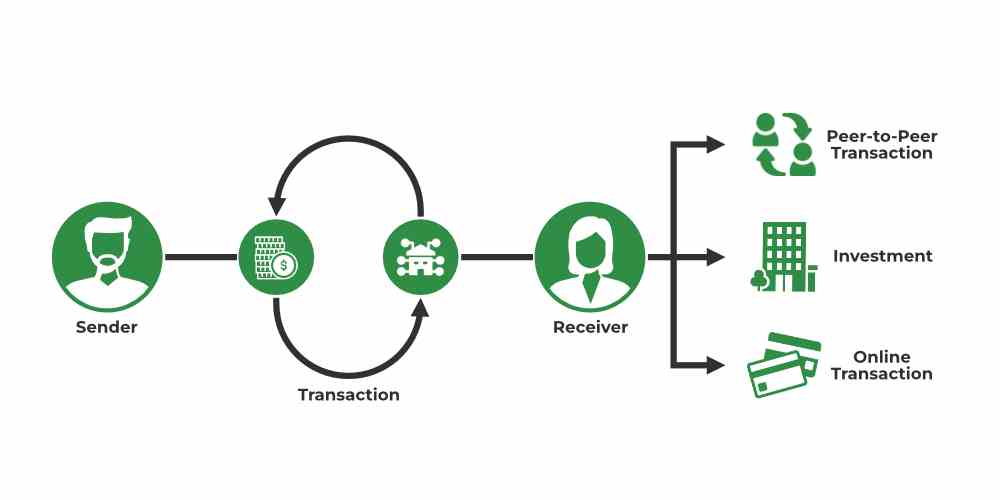

At it’s core, Ripple is a technology company that provides a global payment network for financial institutions. It aims to make cross-border transactions faster, cheaper and more efficient by leveraging blockchain technology and digital assets.

Think of it this way: imagine you’re a small business owner in the United States who needs to send money to a supplier in Japan. Traditionally, this process would involve multiple intermediaries, high fees and a lot of waiting time. It’s like sending a letter via carrier pigeon – slow, unreliable and prone to getting lost along the way.

Enter Ripple. With it’s blockchain-based network, Ripple enables financial institutions to send money directly to each other, bypassing the need for intermediaries. It’s like upgrading from a carrier pigeon to a supersonic jet – fast, efficient and reliable.

How Does Ripple Work?

Ripple’s payment network, called RippleNet, is built on top of a distributed ledger technology (DLT) called the XRP Ledger. This ledger is a decentralized, open-source platform that allows for the secure and efficient transfer of value.

Here’s a simplified explanation of how a cross-border transaction works on RippleNet:

- Bank A wants to send money to Bank B in another country.

- Bank A initiates the transaction on RippleNet, specifying the amount and destination.

- Ripple’s software, called xCurrent, instantly communicates the transaction details to Bank B.

- Bank B receives the transaction details and confirms the transaction.

- Ripple’s software, called xRapid, can optionally be used to convert the funds into XRP (Ripple’s digital asset) and then back into the destination currency, reducing liquidity costs and transaction times.

- The funds are settled between the two banks and the transaction is complete.

It’s like a high-speed, global game of telephone, but instead of messages getting lost in translation, money moves seamlessly and securely across borders.

Ripple’s Role in Cross-Border Payments

Some of The Drawbacks Traditional Cross-Border Payments Compared to Ripple Model

Traditional cross-border transactions are fraught with challenges, including extended processing times, high fees and a lack of transparency. These inefficiencies create barriers for businesses and individuals engaged in international trade.

- High fees: Cross-border transactions often involve multiple intermediaries, each charging their own fees, leading to high overall costs.

- Slow transaction times: With multiple parties involved and different payment systems to navigate, cross-border transactions can take several days to complete.

- Lack of transparency: It can be difficult to track the status of a cross-border payment, leading to uncertainty and frustration for both the sender and receiver.

- Currency conversion: Converting funds from one currency to another can be costly and time-consuming, adding an extra layer of complexity to cross-border transactions.

These pain points are like the thorns on a rose – they make the process of sending money across borders a prickly and unpleasant experience.

How Ripple Addresses These Pain Points

Ripple aims to address these pain points by leveraging it’s blockchain technology and global network of partners. Here’s how:

- Lower fees: By eliminating the need for multiple intermediaries, Ripple reduces the overall cost of cross-border transactions. It’s like cutting out the middleman and going straight to the source.

- Faster transaction times: Ripple’s network enables real-time communication between financial institutions, allowing for faster transaction settlement. It’s like upgrading from a snail-mail system to instant messaging.

- Improved transparency: Ripple’s blockchain technology provides a transparent and immutable record of transactions, allowing for easy tracking and auditing. It’s like having a crystal-clear window into the journey of your money.

- Efficient currency conversion: Ripple’s xRapid solution uses XRP as a bridge currency, enabling efficient and low-cost currency conversion. It’s like having a universal translator for your money, breaking down the language barriers between currencies.

By addressing these pain points, Ripple is making cross-border payments faster, cheaper and more efficient, like a superhero swooping in to save the day for global commerce.

Smart Contracts on Ripple

Smart contracts, self-executing agreements with coded terms, have become integral to blockchain technology. Ripple, recognizing their potential, has integrated smart contract functionality into it’s platform to enhance the capabilities of it’s network.

Integration of Smart Contracts in Ripple

Ripple’s incorporation of smart contracts expands the range of applications within it’s ecosystem. This feature allows for programmable, automated agreements, opening up possibilities for more complex and customizable financial transactions on the Ripple network.

Use Cases and Implications for Financial Transactions

The introduction of smart contracts on Ripple introduces a myriad of use cases, from automated cross-border payments to conditional agreements based on predefined criteria. This functionality enhances the versatility of the Ripple network, making it adaptable to a wide range of financial scenarios.

Future Prospects and Developments

Ripple’s Ongoing Research and Development

Ripple remains at the forefront of research and development, continually seeking ways to enhance it’s network’s capabilities. Ongoing efforts include exploring scalability solutions, improving user experience and adapting to emerging technological trends.

- Central Bank Digital Currencies (CBDCs): Ripple is actively exploring the development of CBDCs, collaborating with central banks and financial institutions to create digital currencies for various use cases.

- University Blockchain Research Initiative (UBRI): Ripple supports academic research in blockchain technology and cryptocurrency through UBRI, partnering with over 50 universities worldwide to drive innovation and adoption.

- Interoperability and Scalability: Ripple is working on improving the interoperability of different blockchain networks and enhancing the scalability of its own blockchain to support more users and transactions.

Ripple’s vision extends beyond just improving cross-border payments. The company aims to power what it calls the “Internet of Value” – a world where value can be exchanged as easily as information is exchanged on the internet today.

In this vision, anything of value – whether it’s money, gold or even loyalty points – could be easily and instantly transferred across borders and between different systems. It’s like creating a global, digital marketplace where value flows as freely as water.

The ability to easily and instantly transfer value across borders could enable entirely new business models and industries. For example, imagine a global marketplace for renewable energy, where individuals and businesses can easily buy and sell excess solar or wind power using Ripple’s technology.

Or picture a world where artists and creators can easily sell their work to a global audience, receiving instant payments in any currency, without the need for intermediaries. Ripple’s technology could be the brush that paints this new landscape of global commerce.