I’ve always been intrigued by how different cryptocurrencies run their networks. It’s like looking under the hood of a car to see what powers it. Some projects rely only on Proof-of-Work (PoW), others go fully with Proof-of-Stake (PoS), while certain coins dare to blend both. Peercoin is one of those coins that grabbed my attention because it uses a Hybrid Consensus Mechanism. If you’re new to these terms, don’t worry; we’ll walk through them step by step. This hybrid approach offers enhanced security, scalability and energy efficiency, making Peercoin a standout player in the blockchain world. For all crypto followers, visit quantumtradewave.org and start your trading journey.

I remember when I first heard about Peercoin’s dual system. It sounded like mixing two different recipes to get a perfect meal. PoW often reminds me of a bunch of people racing to solve a puzzle, while PoS feels like receiving dividends for holding shares. Combining both might feel complicated, but once you see the bigger picture, you realize it can bring the best of both worlds. Think of it like a hybrid car that can run on gas and electricity — flexible and possibly more efficient.In this article, you and I are going to explore Peercoin’s Hybrid Consensus Mechanism by looking at both it’s Proof-of-Work side and it’s Proof-of-Stake aspect. We’ll talk about why this combination exists, how it works under the hood and what future possibilities it offers. By the end, I hope you’ll have a clear view of whether this structure is just a passing fad or if it’s the path more projects might take.

Contents

- 1 The Roots of Peercoin

- 2 Proof-of-Work Basics

- 3 Understanding Proof-of-Stake

- 4 How Peercoin Combines PoW and PoS?

- 5 Personal Observations on Hybrid Consensus

- 6 Benefits of Hybrid Consensus Mechanisms

- 7 Challenges and Criticisms

- 8 Step-by-Step Guide: How to Stake on Peercoin

- 9 Comparisons with Other Blockchains

- 10 Real-World Use Cases of Peercoin

- 11 Future Outlook for Hybrid Consensus Mechanisms

- 12 Summary of Key Insights

- 13 Conclusion

- 14 FAQs

- 15 Summary

The Roots of Peercoin

The Vision Behind Peercoin

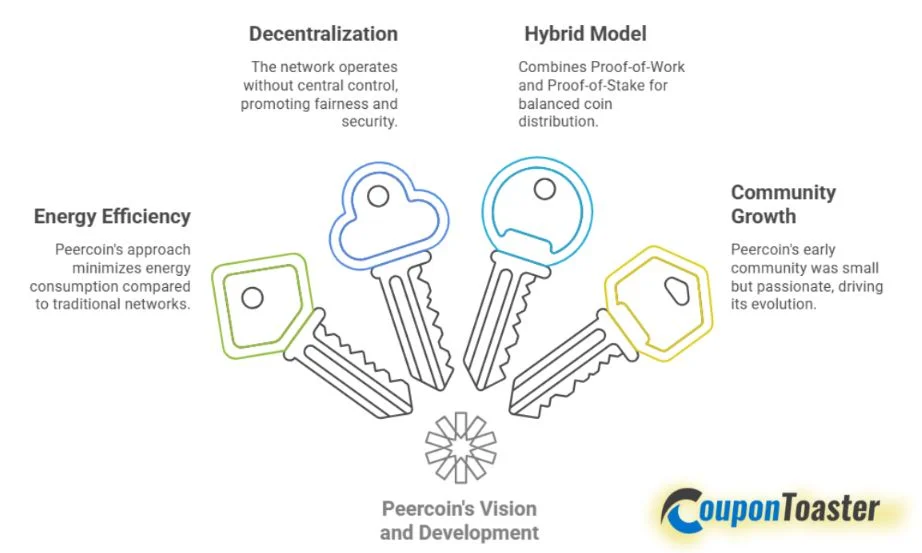

Peercoin has a unique story in the crypto world and understanding it’s roots helps us appreciate why it embraced a hybrid approach. Peercoin was launched in 2012 by it’s pseudonymous creator Sunny King, who had a vision of a more energy-efficient blockchain. In the early days, there were growing concerns about how Proof-of-Work-based networks consumed electricity. I recall reading forums back then and many people, myself included, worried about Bitcoin’s scaling and environmental impacts. Peercoin aimed to address this issue by integrating a new idea: Proof-of-Stake.

But it wasn’t just about being environmentally conscious. The vision also revolved around creating a network that could sustain itself over time without central control. Peercoin’s founders believed in genuine decentralization and saw PoS as a way to distribute coin ownership more fairly and securely. Instead of rewarding just miners with specialized hardware, Peercoin also rewarded those who held coins in their wallets.

Early Developments

When Peercoin first hit the scene, it felt like a breath of fresh air in a world dominated by Bitcoin clones. It’s early community was small but passionate, with people who believed in the hybrid model’s potential. As the community grew, so did the coin’s features. Peercoin introduced adjustable block rewards, making it unique compared to other hybrid attempts.

I personally found it interesting how Peercoin balanced it’s reliance on mining with the new stake-based rewards. This approach helped ensure that new coins continued to flow into circulation through traditional mining while also encouraging coin holders to stake and support the network. It was like going to a potluck party where everyone brought something different to the table, ensuring a well-rounded meal.

From these early days, Peercoin set itself apart by demonstrating that a hybrid model could indeed work in the real world. It wasn’t just a theoretical concept. Miners and stakers started to see the benefits of the system, forming a dedicated user base that still exists today.

Proof-of-Work Basics

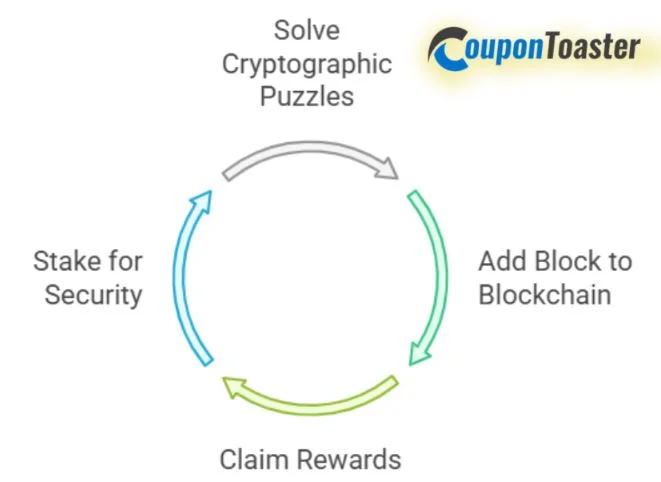

Let’s talk about Proof-of-Work first because that’s the mechanism most people know, thanks to Bitcoin. PoW is about miners doing computational work to solve cryptographic puzzles. These puzzles are tough and solving them requires specialized equipment, like ASICs (Application-Specific Integrated Circuits). The first miner to solve the puzzle gets to add a new block to the blockchain and claim the block reward. This reward typically includes newly minted coins plus transaction fees.

In Peercoin’s context, PoW is still used to mint new coins, although it’s not the exclusive method for generating blocks. The mining process in Peercoin is similar to Bitcoin: You set up your hardware, point it to the network and race against other miners to solve the math problem. When you succeed, you’re rewarded with Peercoins.

The difference here is that Peercoin doesn’t rely solely on mining for security. Rather, it uses PoW to introduce coins into the system but depends more heavily on PoS to keep the network secure and decentralized in the long run. This duality is crucial because it addresses one of the biggest criticisms of pure PoW: the growing centralization among large mining farms. In Peercoin’s world, the stakers also have a say and that’s where the second part of the equation—Proof-of-Stake—comes into play.

Understanding Proof-of-Stake

Staking Process

Now, let’s shift gears to Proof-of-Stake, often seen as the more eco-friendly approach. If PoW is like running a race, PoS is more like collecting ticket stubs. Instead of using computing power, you hold coins in a wallet and by doing so, you earn the right to validate new blocks and add them to the chain. In Peercoin, the more coins you hold (and the longer you’ve held them), the higher your chances of being selected to forge or stake the next block.

The actual process can feel almost too simple. You unlock your wallet for staking and the wallet software does the rest in the background. Periodically, you’ll notice that you’ve minted a new block and in return, you receive a staking reward. It’s a bit like getting interest in a savings account. From my personal experience, the trickiest part was just remembering to keep my wallet open and synced with the network.

Security Aspects

Security in PoS systems relies on the logic that attacking the network is harder when you need to own a large stake of the cryptocurrency itself. If someone wanted to compromise Peercoin, they’d need to acquire a significant portion of the available Peercoins. This becomes expensive and also counterproductive, because if you successfully damage the network, the value of the coins you bought might plummet.

From a day-to-day user perspective, having a stake in the system often encourages people to act in the network’s best interest. It’s like owning a piece of a sports team. If you want your team to succeed long-term, you do your best to support it rather than tear it down. This built-in incentive is what makes PoS attractive, especially for folks who don’t want to deal with noisy, power-hungry mining rigs.

How Peercoin Combines PoW and PoS?

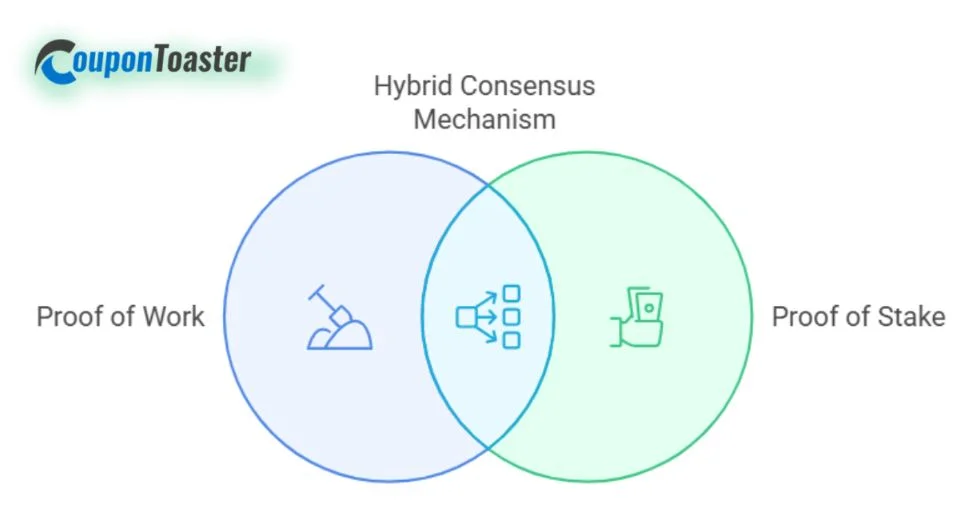

Balancing Security and Efficiency

One of the coolest things about Peercoin is how it marries the two systems—PoW and PoS—without them stepping on each other’s toes. PoW miners do their job to introduce new coins and secure part of the network, while stakers with PoS maintain ongoing security. It’s a balanced dance, much like a sports team that relies on both offensive and defensive players.

Peercoin’s network protocol ensures that blocks can be found via PoW or PoS and this dual generation of blocks forms the backbone of the Hybrid Consensus Mechanism. If you imagine a two-lane road, one lane is for mining and the other is for staking. Sometimes, mining finds the next block and sometimes staking does. This balance can reduce the reliance on heavy mining gear over time, making the system more sustainable.

Synergy of the Two Mechanisms

What’s really fascinating to me is how PoW and PoS feed into each other in Peercoin. Miners who earn new coins via PoW can become stakers later on if they choose to hold onto their newly minted coins. Meanwhile, longtime stakers might occasionally dip their toes into mining to get additional rewards. This interplay strengthens the network’s overall health.

It also creates a scenario where different types of participants can coexist, each contributing their part. Think of a community where farmers grow the crops and shopkeepers sell them. Each role is important and everyone benefits from the collective effort. In Peercoin’s network, this synergy means you don’t have to pick sides between PoW and PoS — you can take advantage of both.

Personal Observations on Hybrid Consensus

I’ve personally spent time dabbling in both mining and staking on Peercoin. Back in my college days, I set up a basic mining rig in my dorm room. The electricity was free (which my roommates were happy about, until they heard the noise!), so I could experiment without huge costs. But after some time, I started staking the coins I mined and that shift felt like a natural progression.

What stood out to me was the convenience of staking. My computer was already on most of the day, so why not keep the wallet running and secure the network? It felt good knowing that I was contributing to the blockchain in a less energy-intensive way. And the small but steady trickle of staking rewards was a pleasant bonus.

My journey taught me that this Hybrid Consensus Mechanism isn’t just a gimmick. It’s an approach that supports different types of users with different goals. Some folks really enjoy the technical challenge of mining, while others prefer a more hands-off, eco-friendly approach. By providing both options, Peercoin fosters a more diverse community, which in turn might lead to greater resilience and a broader user base.

Benefits of Hybrid Consensus Mechanisms

Efficiency

When we talk about efficiency, we often focus on energy use and the ability to process transactions without excessive delays. A hybrid model can help on both fronts. PoW handles coin distribution without overwhelming the grid, especially if mining difficulty is managed well. PoS, on the other hand, requires substantially less power. So in theory, you’re cutting down on some environmental impact compared to a system that relies solely on mining.

From my point of view, this dual setup might also reduce bottlenecks. If for some reason PoW mining becomes too concentrated in one region or dominated by a single group, the PoS component can still keep the network secure. Likewise, if stakers become complacent, miners can step in. It’s like having two backup generators instead of just one.

Security and Decentralization

Security is a huge factor in any blockchain’s success and decentralization is the cornerstone of that security. A purely PoW system can drift toward centralization when mining becomes industrialized. A purely PoS system might lean toward centralization if a few big holders control a large share of the tokens. By combining both, Peercoin aims to distribute power more evenly.

You might picture it like this: If you only had two locks on your door, a thief could figure out a way to pick both eventually. But if you add multiple layers of locks, alarms and cameras, the job gets much harder. In Peercoin, any single player wanting to dominate the network would need to control a huge chunk of hashing power (for PoW) and a large portion of the coin supply (for PoS). That’s a tall order and it makes the network tougher to compromise.

Challenges and Criticisms

Network Adoption

No system is perfect and hybrid consensus models have their share of hurdles. One of them is achieving broad adoption. Blockchain projects often compete with each other for market share, user attention and developer talent. For a coin like Peercoin that uses a Hybrid Consensus Mechanism, attracting both miners and stakers can be a challenge. Miners might find better profitability in a pure PoW coin, while stakers might prefer a full PoS network with simpler processes.

In my personal experience, I’ve seen some folks shy away from Peercoin because they misunderstand how the hybrid model works. They might think it’s less stable or more confusing. However, communities like Peercoin’s have tried to educate newcomers through forums, chat rooms and guides. Still, adoption is often a slow grind for any project that isn’t riding a huge wave of hype.

Complexity

You can’t ignore the added complexity. Running a hybrid blockchain means maintaining two consensus protocols simultaneously. This can complicate the codebase, require more specialized updates and demand that users learn about both PoW and PoS. If there’s a bug or issue in either protocol, it can affect the whole network. Some developers may avoid hybrid projects because debugging and maintenance can be more time-consuming.

Additionally, critics argue that if a network doesn’t need both PoW and PoS to function well, then the extra layer might be unnecessary. The counterargument is that each part has a distinct role, like the engine and the battery in a hybrid car. But the debate continues and it will likely persist as more projects explore or refine hybrid approaches.

Step-by-Step Guide: How to Stake on Peercoin

If you’re curious about staking Peercoin, here’s a simple checklist. When I first started, I found these steps helpful:

- Download a Wallet: Head to the official Peercoin website and download the core wallet appropriate for your operating system.

- Sync Your Wallet: Once installed, let the wallet sync with the blockchain. This can take some time, depending on your internet speed and the network’s size.

- Fund Your Wallet: Transfer some Peercoins into your new wallet. Make sure the coins appear in your balance.

- Unlock for Staking: Most Peercoin wallets have an option to “Unlock for Staking Only.” This keeps your coins secure while allowing them to stake.

- Keep Wallet Running: The wallet needs to be online and connected to the network. Staking rewards come at random intervals, but more coins and longer coin age can improve your odds.

- Earn Rewards: When your wallet stakes a block, you’ll receive newly minted coins as a reward.

Remember, I once forgot to keep my wallet unlocked and wondered why I wasn’t getting any staking rewards. Don’t make my mistake—always double-check your settings!

Comparisons with Other Blockchains

It’s worth looking at how Peercoin’s approach stacks up against other blockchains:

| Blockchain | Consensus Model | Pros | Cons |

| Bitcoin | PoW | Highly secure, widely adopted | Energy-intensive, centralized mining |

| Ethereum | PoS (post-merge) | Lower energy use, large community | Complex transition, potential for large stakeholder dominance |

| Peercoin | Hybrid (PoW + PoS) | Balanced security, flexible rewards | Slower adoption, increased complexity |

| Nxt | PoS | Fully PoS from the start | Less proven than PoW historically |

| Decred | Hybrid (PoW + PoS) | Strong governance, dual-layer security | Requires more involvement from participants |

From this table, you can see that Peercoin’s dual approach sits somewhere between Bitcoin’s fully PoW system and Ethereum’s fully PoS model. Each has it’s trade-offs, but Peercoin shines in it’s attempt to combine the strengths of both.

Real-World Use Cases of Peercoin

While Peercoin isn’t the most hyped coin, it still finds usage among those who value stability and sustainability. Over the years, I’ve encountered online merchants who accept Peercoin because they appreciate it’s energy-friendly ethos. Some developers build dApps (decentralized applications) on top of Peercoin’s blockchain, leveraging it’s lower transaction fees relative to bigger networks.

For people like me who prefer a steady, long-term approach rather than quick speculations, Peercoin can be a place to park funds and earn staking rewards. It’s also a sort of educational playground. If you’re interested in learning about both mining and staking without diving into two different coins, Peercoin offers a unified platform to experiment with.

Though it’s not aiming to become a universal payment system on the scale of Bitcoin, Peercoin does remain an interesting, quietly persistent project that showcases how a Hybrid Consensus Mechanism can be applied in real life. And who knows? Maybe as the crypto world evolves, the demand for more flexible models will bring new attention to Peercoin.

Future Outlook for Hybrid Consensus Mechanisms

When I think about the future of hybrid consensus, Peercoin often comes to mind as an early pioneer. The idea of mixing PoW and PoS might become more prevalent if energy concerns and decentralization remain hot topics. Some projects are already adopting partial hybrid models or exploring new variations like Proof-of-Capacity or Delegated Proof-of-Stake. The core idea remains the same: find the perfect balance between resource use, network security and user engagement.

In the long run, the crypto community might view pure PoW systems as relics of the past due to their massive energy consumption. Pure PoS, while promising, could face scrutiny if large stakeholders start exerting too much influence. Hybrid systems might be the middle ground that addresses these issues without swinging too far in one direction.

Yet, the success of any hybrid model will hinge on community support, developer talent and real-world adoption. If projects like Peercoin continue to demonstrate stability and steady growth, more folks will see hybrids as a viable path forward. I’m personally excited to see if new innovations will build on Peercoin’s foundation or propose entirely new ways of blending consensus methods.

Summary of Key Insights

- Hybrid Consensus Mechanism: This is a model that uses more than one consensus algorithm (like PoW and PoS) to secure the blockchain.

- Peercoin’s Two-pronged Approach: Peercoin uses PoW to distribute new coins and PoS to keep the network running efficiently and securely.

- Advantages: Better energy efficiency than pure PoW, potentially stronger security than pure PoS and a community that can choose how they want to participate (mining or staking).

- Drawbacks: Slower adoption, increased complexity and possible misunderstanding from users unfamiliar with hybrid models.

- Future Prospects: As energy consumption and centralization concerns grow, hybrid systems could become more popular. Peercoin might continue to serve as a testbed or role model for others.

From my perspective, it’s all about finding balance. By carefully blending PoW and PoS, Peercoin manages to stand out in a crowded crypto landscape, even if it doesn’t always grab the headlines.

Conclusion

The world of cryptocurrency is vast and many projects have come and gone. Peercoin has endured by offering a balanced approach through it’s Hybrid Consensus Mechanism, showcasing that it’s possible to merge PoW and PoS for a more sustainable and secure ecosystem. Through my personal journey of mining and staking, I’ve seen firsthand how a hybrid model can cater to different preferences and still maintain a robust network.

As the crypto landscape evolves, it’s worth keeping an eye on hybrid solutions like Peercoin. Whether you’re an enthusiast eager to try out both mining and staking or just someone curious about next-gen blockchain models, Peercoin offers a real-world example of how the theory plays out in practice. It’s not just a whitepaper dream—it’s a working system with a dedicated community behind it. And who knows? Maybe one day, hybrid models will become the new norm, bridging the gap between traditional mining and more modern staking methods.

FAQs

Peercoin’s protocol allows both PoW and PoS blocks to be found. Whichever block gets discovered first becomes part of the chain. This can lead to a chain of PoW blocks followed by some PoS blocks or vice versa.

Absolutely. You can dedicate part of your computational power to mining while keeping some coins in your wallet to stake. Doing both maximizes your potential rewards and supports the network from two angles.

Staking itself is fairly low-risk if you secure your wallet properly. However, like any crypto investment, there’s always market volatility. Make sure you protect your private keys and use a reliable wallet.

Peercoin doesn’t have a hard cap like Bitcoin. New coins are generated through mining and staking rewards. However, the overall inflation is designed to be relatively low compared to many other cryptos.

Yes. Other projects, like Decred, also use hybrid models. These approaches can be adapted for different blockchain purposes, especially where teams want a combination of mining distribution and staking security.

Summary

Peercoin’s hybrid consensus mechanism blends Proof-of-Work (PoW) and Proof-of-Stake (PoS) to achieve improved security, efficiency and decentralization. PoW miners introduce new coins, while PoS stakers secure the network by validating transactions. By combining both methods, Peercoin balances energy usage and rewards distribution. This approach mitigates challenges faced by pure PoW and pure PoS systems, such as centralization and high energy consumption. Peercoin encourages both miners and coin holders to contribute, benefiting from broader community participation. Although it can be more complex to manage, Peercoin demonstrates that hybrid models offer a viable, forward-thinking solution to blockchain’s future scalability and sustainability concerns.