Cryptocurrencies are becoming more and more popular in our digital world today. Bitcoin (BTC) has become the most widely used type of cryptocurrency and it offers many benefits for businesses of all sizes. If you’re interested in starting your crypto journey, you can use platforms like cryptoengine.app to begin! Many business owners have shared their positive experiences with cryptocurrency adoption. For example, a small online retail store owner reported a 25% increase in international sales after accepting Bitcoin payments, while a freelance marketplace saw a 40% reduction in payment processing fees after implementing crypto payment options.

Cryptocurrencies are growing to become increasingly well-liked in our digital era. For this excellent purpose, BTC has become the most popular and widely used kind of bitcoin; it offers several benefits to companies. Would You Like to Begin Trading Crypto? Utilize the cryptoengine.app Program!

Contents

Why Should Businesses Use Cryptocurrency?

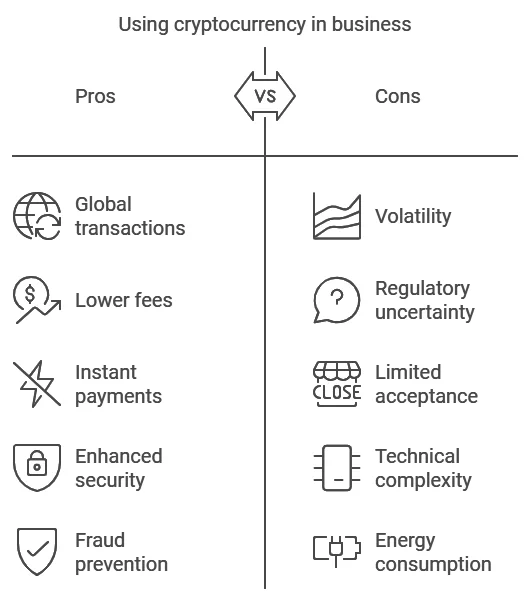

There are many good reasons why businesses are starting to use cryptocurrency. The biggest advantage is that you can do business with anyone around the world without worrying about exchange rates or bank fees. Think about sending money to someone in another country – usually, you’d have to pay high fees and wait several days for the money to arrive. With cryptocurrency, you can send money instantly and the fees are much lower. Many online businesses have found that accepting crypto payments has helped them reach customers in countries where traditional payment methods are less common or more expensive to use.

Cryptocurrency is also very secure, which is another big plus for businesses. Every transaction is recorded on something called a blockchain, which is like a big digital record book that everyone can see but nobody can change. This means it’s nearly impossible for someone to fake transactions or steal money. The system uses complex math problems to keep everything safe and thousands of computers around the world work together to make sure all transactions are real. Business owners have reported feeling more confident about accepting large payments through cryptocurrency because they don’t have to worry about fraudulent chargebacks or payment disputes.

Motives for Using Cryptocurrency in Company

There are several benefits to beginning to use cryptocurrency for companies. As a result, you may do business with anybody worldwide without worrying about currency conversion rates or processing fees.

Exceptionally safe money is cryptocurrency. A crypto is a publicly accessible distributed ledger where network elements continuously document activities after cryptographically authenticating. As a result, it is hard for anybody to hack or duplicate the money. Finally, adopting Bitcoin may provide cost savings. Since BTC is decentralized and has no linked transaction cost, you may use it without depending on third parties like PayPal or payment card firms.

Arguments Against Using Bitcoin in Company

However, there are several factors that you may decide against using Bitcoin in the company. First, Bitcoin is still the latest technology, so it’s protracted sustainability is not assured. Furthermore, adopting cryptocurrency for commercial purposes might harm your brand’s reputation since it is often linked to unlawful activity. The cost of Bitcoin may fluctuate wildly and it is sometimes apparent what it should be. Your company can experience instability. As a result, making it takes work to set long-term plans.

Common BTC Cloud Services

Let’s discuss some of the uses for bitcoin that companies may take advantage of now that you have a better understanding of precisely what it is and how something functions. Here are several of the most typical uses:

- allowing consumers to pay with bitcoin; – paying vendors or freelancers using cryptocurrency.

- keeping a bitcoin commitment.

These implementations each have a unique set of benefits. For instance, you may avoid the counterparty risk imposed by conventional payment systems when you take bitcoin trading. Additionally, because bank transactions do not need to clear before paying bills or customers using bitcoin, payment is made more promptly.

Each one of these uses does, of course, have certain dangers. For instance, you may lose revenue if you keep bitcoin as a property due to it’s potential for volatility. Additionally, you must confirm that vendors and providers will receive cryptos as payment before using crypto to pay them. However, there are some significant benefits to utilizing bitcoin for business.

Security Features That Matter for Your Business

When you’re running a business, keeping your money safe is super important. Cryptocurrency offers some really strong security features that can help protect your business funds. Unlike regular bank accounts that can be hacked or credit card numbers that can be stolen, cryptocurrency uses special codes called private keys that only you have access to. Think of it like a super-strong password that nobody else can guess. Many business owners love this feature because they don’t have to worry about someone stealing their banking information or making fake charges. The blockchain technology behind cryptocurrency keeps track of every single transaction and once something is recorded, it can’t be changed. This means you have a perfect record of all your business dealings, which is great for keeping track of your money and making sure everything is correct. Some businesses even use special cryptocurrency wallets that require multiple people to approve big transactions, which adds an extra layer of security. This is especially useful for businesses with multiple partners or departments that handle money.

Practical Steps for Getting Started

Getting started with cryptocurrency in your business doesn’t have to be complicated. Here’s a simple list of steps to follow:

1. Set Up Your Business Cryptocurrency Wallet

- Choose a trusted, well-known wallet provider with good security features

- Consider both hot wallets (online) and cold wallets (offline storage) for different amounts

- Look for wallets that offer business-specific features like multiple user access

- Make sure to back up your wallet information in a secure location

- Start with a small amount to test the wallet’s features

2. Choose Your Cryptocurrencies

- Begin with Bitcoin as it’s the most widely used and accepted

- Consider adding Ethereum if there’s demand from your customers

- Research which cryptocurrencies are popular in your industry

- Start with just 1-2 types of cryptocurrency to keep things simple

- Make sure your chosen cryptocurrencies have good trading volume

3. Set Up Your Payment System

- Research and compare different cryptocurrency payment processors

- Look for processors that offer automatic conversion to regular currency

- Check the fees and transaction limits of each processor

- Make sure the processor integrates with your existing payment systems

- Test the system with small transactions before going live

4. Prepare Your Business Operations

- Create clear procedures for handling cryptocurrency payments

- Train your staff on basic cryptocurrency concepts and security

- Set up proper record-keeping systems for tax purposes

- Establish policies for handling price fluctuations

- Create backup plans for technical issues

5. Start Small and Scale Up

- Begin by accepting small cryptocurrency payments

- Set a maximum limit for cryptocurrency transactions at first

- Monitor each transaction carefully to ensure everything works

- Gradually increase limits as you become more comfortable

- Keep track of what works and what needs improvement

6. Maintain Security Practices

- Use strong passwords and two-factor authentication

- Keep most of your cryptocurrency in secure offline storage

- Regularly update your security software

- Create backup copies of all important information

- Train staff on security best practices

7. Stay Compliant

- Keep detailed records of all cryptocurrency transactions

- Save records of conversion rates at the time of transactions

- Work with an accountant who understands cryptocurrency

- Stay updated on cryptocurrency regulations in your area

- Set aside money for taxes on cryptocurrency earnings

8. Monitor and Adjust

- Keep track of which cryptocurrencies are most used by customers

- Watch for any payment processing issues

- Adjust your policies based on actual usage

- Stay informed about cryptocurrency market trends

- Get feedback from customers about the payment process

Remember: Many successful businesses started small with cryptocurrency and grew their usage over time as they became more comfortable with the system. There’s no need to rush – taking careful steps and learning as you go is the best approach.

Tax Consequences of Using BTC

Another consideration is the effects of utilizing Bitcoin on taxes. There are many murky regions when it relates to cryptocurrencies. Because BTC is still so young, there are few conclusive solutions available. Stop losses are an excellent strategy to keep your losses on a transaction to a minimum. If users set stopped losses too near to the stock’s current price, even a little decline in price might cause it to be activated. “Getting destroyed out” describes this situation. To prevent this, you must ensure that your stop losers are positioned a healthy distance from the current valuation.

What we do know, though, is that you will often be taxable on any profits you earn from utilizing BTC. Therefore, if you purchase this for $100 and sell it for $150, you will be required to pay taxes on the $50 profit. There are certain exceptions, however. For instance, you typically are not required to worry about owing taxation on payments made using BTC for daily consumption (such as getting a hairdresser or a cup of coffee). As a standard rule of thumb, you should always speak with a tax professional unless you consider utilizing Bitcoin commercially. They can guide you through tricky situations and ensure you follow the rules.

Conclusion

Are you ready to start using Bitcoin in your business? Many companies have found that it helps them avoid expensive fees and makes international business much easier. Your customers can feel secure knowing their purchases are protected because Bitcoin doesn’t allow chargebacks. Whether you’re a small business owner or running a large company, cryptocurrency might be worth considering as a payment option. Want to learn more? Get in touch to discover how Bitcoin can help your business grow in today’s digital economy.

Remember to always consult with financial and legal experts before making any major changes to your business payment systems. While cryptocurrency offers many benefits, it’s important to understand all aspects before diving in.