Dive into the dynamic world of cryptocurrency liquidity as we uncover the top contenders in the market. Discover why liquidity matters and how it impacts your investment strategies. Join us on a journey to explore the exceptional liquidity of the top three cryptocurrencies, setting the stage for informed decision-making in the fast-paced realm of digital assets.

- Bitcoin (BTC)

Bitcoin (BTC) stands as the pioneer and undisputed leader in the realm of cryptocurrencies, with its unparalleled liquidity setting the standard for all others to follow. It’s the OG of cryptocurrencies. It’s like the cool kid on the block that everyone knows and wants to hang out with. Because of this, Bitcoin has a huge market cap of over $ 1,27B as of June 2024. That’s a mind-boggling amount of money, and it means that there are a ton of people and institutions invested in Bitcoin. Bitcoin has followed this liquidity gauge perfectly since its inception.

Now, when we talk about liquidity, we’re basically talking about how easy it is to buy and sell something without causing the price to go crazy. And let me tell you, Bitcoin is like the most liquid asset in the crypto space. It’s traded on pretty much every crypto exchange out there, and you can buy and sell it using all sorts of different currencies, like USD, EUR, and even other cryptocurrencies. This is super important because it means that whenever you want to buy or sell Bitcoin, you can do it quickly and easily without having to worry about the price suddenly changing on you. It’s like having a bunch of stores that all sell the same thing – you know you can always find what you need, and the prices will be pretty similar no matter where you go.

Plus, Bitcoin has all these cool financial tools like futures and options that make it even more attractive to traders and investors. It’s like having a whole toolbox full of different ways to make money with Bitcoin, which just adds to its overall liquidity.

So, when you put all of this together – the massive market cap, the widespread availability, and the fancy trading tools – it’s no wonder that Bitcoin is the most liquid cryptocurrency out there. It’s like the superstar of the crypto world, and everyone wants a piece of the action!

The liquidity of Bitcoin is a multifaceted phenomenon, driven by several key factors. Firstly, its market capitalization dwarfs that of any other cryptocurrency, with Bitcoin consistently accounting for a significant portion of the total crypto market cap. This immense market cap not only reflects Bitcoin’s widespread adoption but also contributes to its liquidity by ensuring ample funds are available for trading at any given time.

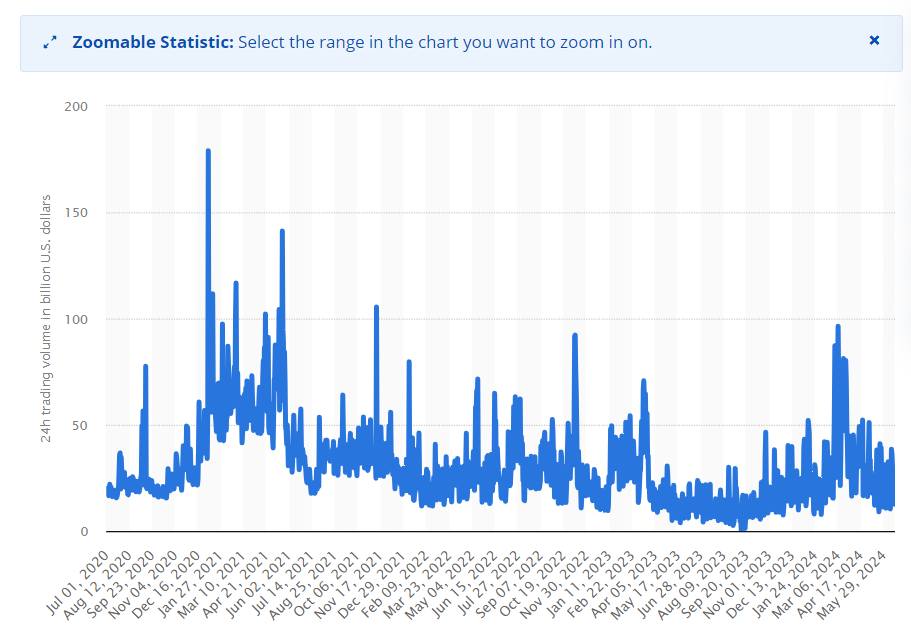

Moreover, Bitcoin boasts staggering trading volumes across various exchanges worldwide, further solidifying its liquidity credentials. The high trading activity surrounding Bitcoin ensures that buyers and sellers can swiftly execute their orders without experiencing significant price slippage, a crucial aspect for liquidity.

Delving deeper, one must also consider Bitcoin’s market depth, which refers to the ability of the market to absorb large buy or sell orders without causing substantial price fluctuations. Thanks to its robust and mature market infrastructure, Bitcoin exhibits impressive market depth, making it an attractive option for institutional investors and high-net-worth individuals seeking to trade large volumes of cryptocurrency.

- Ethereum (ETH)

First off, Ethereum is like the silver to Bitcoin’s gold. It’s the second-largest cryptocurrency by market cap, and that’s a big deal. As of February 2023, Ethereum’s market cap was around $200 billion. and now in June 2024, Ethereum’s market cap is around $425.68+ Billion. That’s a huge chunk of change, and it means that there are a lot of people interested in Ethereum.

But what really sets Ethereum apart is its utility. You see, Ethereum isn’t just a digital currency – it’s a whole platform for building decentralized applications (dApps). These dApps can do all sorts of cool things, like creating smart contracts, managing decentralized finance (DeFi) projects, and even running entire organizations autonomously.

This utility is what makes Ethereum so valuable, and it’s also what helps to ensure its liquidity. Because so many people are using Ethereum to build and use dApps, there’s always demand for ETH. This constant demand means that there’s always someone willing to buy or sell ETH, which keeps the market moving smoothly.

Plus, Ethereum has recently gotten a big boost in the form of ETF approvals. The US Securities and Exchange Commission (SEC) has given the green light for eight exchange-traded funds (ETFs) backed by spot Ether. This is huge news, because it means that institutional investors (think big banks and hedge funds) can now easily invest in Ethereum without having to buy and hold the actual cryptocurrency.

These ETF approvals are likely to bring even more liquidity to the Ethereum market, as institutional investors pour money into these new investment vehicles. And with more liquidity comes more stability, which is good news for everyone involved in the Ethereum ecosystem.

So, when you put it all together – the large market cap, the utility of the Ethereum platform, and the recent ETF approvals – it’s clear that Ethereum is a top player when it comes to liquidity in the crypto world. It’s like a triple threat: it’s got the size, the skills, and the backing to keep the market humming along smoothly.

One of the main topics of discussion is the recent approval of Ethereum ETFs. This is seen as a significant milestone for Ethereum, as it brings more legitimacy and accessibility to the cryptocurrency. People are excited about the potential for increased adoption and investment in Ethereum as a result of the ETFs.

The emergence of DeFi protocols and applications built on Ethereum has significantly contributed to the platform’s liquidity, as users flock to decentralized exchanges (DEXs), liquidity pools, and lending/borrowing platforms to engage in a wide range of financial activities.

- Binance Coin (BNB)

BNB is the native token of Binance, which is like the biggest cryptocurrency exchange out there. Binance is the top dog when it comes to trading volume, which means that more people are buying and selling cryptocurrencies on Binance than anywhere else. That’s a pretty big deal, because it means that Binance has a ton of liquidity.

And guess what? That liquidity spills over to BNB as well. Because BNB is the native token of Binance, it’s the go-to cryptocurrency for a lot of traders on the platform. This means that there’s always a lot of demand for BNB, which helps to keep its price stable and its liquidity high.

Moreover, BNB’s utility extends beyond the Binance exchange, as the token is increasingly being used in various applications and services within the broader cryptocurrency ecosystem. From decentralized finance (DeFi) platforms to non-fungible token (NFT) marketplaces, BNB’s liquidity is bolstered by its widespread adoption across multiple use cases.

Speaking of price, BNB has been on a tear lately. In fact, just a few weeks ago in June 2024, BNB hit an all-time high of almost $700! That’s a crazy amount of money for a single token, and it just goes to show how much demand there is for BNB. But it’s not just the price that makes BNB special. It’s also the fact that BNB is the only exchange-based native token that has reached such a high price. Other exchanges have their own tokens, but none of them have come close to the success of BNB.

So why is Binance so successful? Well, for one thing, it has a huge user base. In fact, Binance just surpassed 200 million registered users in June 2024. That’s a mind-boggling number of people, and it means that there’s always someone looking to buy or sell cryptocurrencies on the platform. Plus, Binance is known for its top-notch security and its user-friendly interface. This makes it easy for people to trade cryptocurrencies on the platform, which in turn helps to keep the liquidity high.

So, when you put it all together – the high trading volume, the huge user base, and the fact that BNB is the native token of the platform – it’s no wonder that BNB is one of the most liquid cryptocurrencies out there. It’s like the MVP of the crypto world, and it’s showing no signs of slowing down anytime soon!

Do you know: Binance CEO Changpeng “CZ net worth an estimated $40+ billion, and in his X/Twitter profile he claims to be the holder of BTC & BNB.